Table of Content

With that said, you can also bank by phone, online or via mobile app. Lower charges a 1 percent origination fee on all HELOC transactions, so you may want to limit your spending. Lower also has a relatively low line of credit limit at $350,000. Established in 1828, Citizens now has 1,000 branches spread across 11 states in the New England, Mid-Atlantic and Midwest regions.

From there, they will remove these flaws from your report, which will later be reflected in your score by FICO. Or, even if your credit report does not contain errors, if it’s not as great as you’d hoped, you canraise your credit score. To find thebest HELOC rate, it's critical to compare multiple lenders — a rule of thumb is to get quotes from at least three so you can compare rates, fees and terms. You’ll also want to try improving your credit score, clearing out existing debt and making additional mortgage payments to increase your home equity.

What are today's current HELOC rates?

Start by getting current on any past due accounts, if applicable, and be sure to make timely payments moving forward. Pay down any credit card debt as much as you can, and if you owe in many different places, consider a debt-consolidation loan that rolls all your debts into one single monthly payment. Other ways to increase your credit score include avoiding applications for new credit and leaving old accounts in good standing open. Your credit score plays an important role in your financial life. Your score is based on the information on your credit report, and it’s a financial representation of how well you handle credit.

It is recommended that you upgrade to the most recent browser version. The drop in new listings is limiting the housing supply and keeping home prices relatively high despite a cooling in the market. The Redfin report notes that the housing supply dipped 1% from July to August 2022, while supply would experience an uptick under normal conditions. Ng basic demographic and financial information of the prospective borrowers. N on the overall earnings profile remains a key monitorable. Nevertheless, the company has maintained conservative provisioning of 52% for stage-2 assets as on March 31, 2021 which are expected to be utilised in fiscal 2022.

What Is a Good Credit Score to Buy a House?

Courses cover corporate credit, bank and insurance company analysis, corporate finance, risk, and more. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. Residents of Mississippi have the lowest average credit scores nationwide at 681. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate.

There's no quick fix for bad credit, but once you start taking action to improve your score, it can happen over a period of months. Bad marks on your credit report, such as accounts in collections, late payments, or bankruptcies, stay on your report for seven to 10 years. Looking at it from a lender’s perspective, where you land on the credit-scoring scale says a lot about how good you’ll be at repaying a home loan. That’s why lenders set minimum credit scores for a mortgage, and there aren’t many exceptions. It’s a good idea to limit new lines of credit or loans you borrow when you plan to buy a home. Opening new accounts could lower your credit score initially and even lower your age of credit.

Home Loan Essentials

Also, keep in mind, the lock-in effect impacts buyers as well, since higher rates price some sellers out of the market, and present fewer listings to choose from. Over a three-year period from 1978 to 1981, the average monthly rate on a 30-year fixed-rate mortgage spiked from 10.1% to 17.8%. As rates grew higher, fewer homeowners moved, according to the DePaul study. The lock-in effect, not to be confused with rate-locking a mortgage, refers to homeowners who are reluctant to sell their homes amid rising mortgage rates because they have a low interest rate locked in.

Pentagon Federal Credit Union, or PenFed, serves 2 million members in all 50 states, Washington, D.C., and military bases in Guam, Puerto Rico and Okinawa. This credit union offers competitive rates on its HELOCs, along with other financial services, including credit cards, checking accounts, savings accounts, mortgages and auto loans. Since much of your credit score is based on your payment history, paying your credit cards, auto loan, or first mortgage on time can help raise it.

Change is accelerating — and so are the risks that come with it. Are you prepared?

CRISIL Ratings Limited is registered in India as a credit rating agency with the Securities and Exchange Board of India ("SEBI"). However, any further drop in collection efficiency going ahead, may add to pressure on the earnings profile of the company. CRISIL Ratings Limited ('CRISIL Ratings') is a wholly-owned subsidiary of CRISIL Limited ('CRISIL'). Which is expected to impact the overall group credit profile.

The typical credit score range can fall anywhere from 300 to 850, with 850 being a perfect credit score. While each creditor might have subtle differences in what they deem a good or great score, in general an excellent credit score is anything from 750 to 850. A good credit score is from 700 to 749; a fair credit score, 650 to 699. A credit score lower than 650 is deemed poor, meaning your credit history has had some rough patches.

Ramsey refers to this factor as "how long you've been in debt." Like credit cards, HELOCs typically have variable interest rates, meaning the rate you initially receive may rise or fall during your draw and repayment periods. However, some lenders have begun offering options to convert all or part of your variable-rate HELOC into afixed-rate HELOC, sometimes for an additional fee. The higher yourcredit score, the better your rates and the more likely you are to be approved. If you have a credit score in the mid-600s or below, work to pay off existing debt and make timely payments on your credit cards toimprove your score.

Most people who buy a home need a mortgage, and most mortgage lenders check your credit score to determine your loan rate. If you have a high credit score, you'll qualify for much lower mortgage rates. If you have no credit score, you won't qualify for a mortgage with these lenders at all.

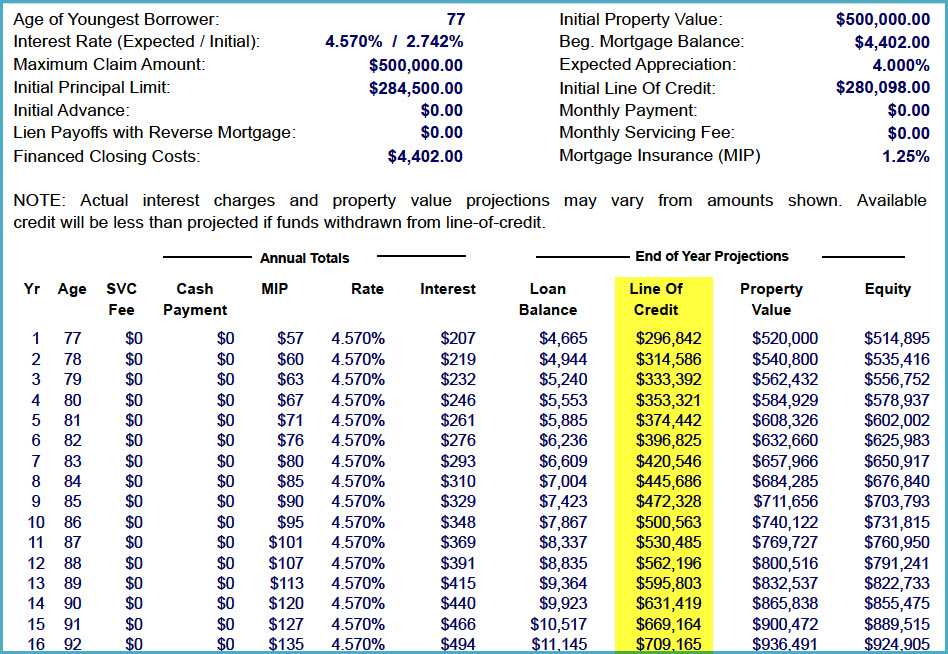

Reverse mortgage - With a reverse mortgage, you receive an advance on your home equity that you don't have to repay until you leave the home. However, these often come with many fees, and variable interest accrues continuously on the money you receive. AHELOCis a variable-rate home equity product that works like acredit card— you have access to a credit line that you can draw from and pay back as needed. Payments vary depending on the interest rate and how much money you have used.

His work has also appeared on MSN Money, USA Today, and Yahoo! Finance. Utilities companies often charge a deposit to new customers with no credit score. That means paying more upfront to set up your water, electricity, gas, and other utilities. It's just as unnecessarily difficult if you're renting instead of buying. Many landlords and property management companies run credit checks on every applicant.

In 2022, interest rates catapulted to levels not seen since 2008 amid the Federal Reserve's clampdown on inflation. The soaring rates come after nearly two years of record-low rates that many homebuyers were eager to capitalize on. CRISIL Ratings Limited ("CRISIL Ratings") is a wholly-owned subsidiary of CRISIL Limited ("CRISIL").

You avoid paying interest and it shows lenders you have the cash on hand to pay for what you borrow. With no money down, you’ll have higher monthly payments, potentially a higher interest rate and less chance of approval compared to someone who provides more cash up front. VA loans and USDA loans both offer financing for low- or no-down payment loans. Some private lenders offer this too—but it will vary depending on the lender. Another way to check what’s on your credit report—including credit problems that are dragging down your credit score—is to get your free copy at AnnualCreditReport.com.

No comments:

Post a Comment